imaginima/E+ via Getty Images

Many times, I get asked about the proper valuation for a company like Headwater Exploration (OTCPK:CDDRF) [HWX:TSX] with the implication that it is time to get out and go elsewhere. But getting out of growing companies into another investment risks losing some of the effect of compounding. Some of the great investors would have advised changing investments when there is a 100% difference in the return to avoid slowing down the accumulation of wealth.

Management just announced the discovery of some medium grade oil deposits to add to the current heavy oil production. Since medium grade oil tends to be more valuable than heavy grade oil, the profitability of the sales mix will increase in the future. What may have been a fully valued stock for some just increased in value. This does not include the acreage that has yet to be derisked. So there could be more good news to come.

The other consideration is that a growing company will keep compounding your return without the interruption of tax payments. It might well be worth a year or two of slow returns in order to capitalize on a decent future.

The other consideration would be to watch industry insiders with a lot of industry experience determine when it is they think it is time to sell. That timing usually indicates that a cyclical downturn is in the near future with an implication for major and sustained capital loss combined with an unsure bounce-back ability.

Right now, I follow several companies where the insiders have been buying into companies like Headwater Exploration and expanding operations. They are not selling and getting out. Many of these insiders have a very profitable history for shareholders. But oftentimes, investors figure that they can do better than management in the process of ending up doing worse.

The reason is that many celebrate those great up years without realizing that a down year can wipe out multiple good years. Most knowledgeable people realize that a 15% loss (for example) takes a far bigger gain to make up the loss and even more to get back “on track” with the investor return. Yet the higher the return you need to get back on track, the less likely it is that you will get back on track. This is the reason that most investors long term average about an 8% annual return instead of that 30% they keep hoping for.

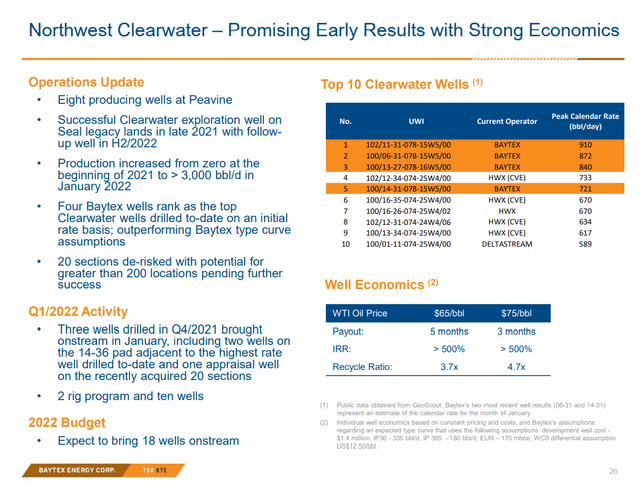

Baytex Energy Northwest Clearwater Profit Characteristics (Baytex Energy March 2022, Corporate Presentation)

Now Baytex Energy (OTCPK:BTEGF) does an excellent presentation of the Clearwater basin profit characteristics that is really the sole operating area for Headwater at the current time. Clearly a basin with the profit characteristics shown above has a lot of room for lesser performance that can still be great (if anyone is worried about it) while fulfilling some comments about low breakeven prices.

In the current environment, the payout (or payback) of these wells is so fast that the company can drill 2 to 4 wells with the same capital money in a fiscal year. That is going to lead to potential production growth that could rival a high-tech company.

Admittedly, Headwater is growing from a low production base. Then again, management states that they have three rigs operating already along with one rig of those three dedicated (currently) to exploration. Given the profitability shown above, that report should not surprise anyone.

The name of the game should be to increase cash flow through fast paybacks as long as the company can so that the reduced cash flow during a cyclical downturn allows the company to cheaply and profitably expand production to take advantage of the next upturn while beginning a cash return to shareholders or a stock repurchase program.

Right now, the market demand means that many companies are giving up hundreds of percent returns to pay a dividend or sensibly reduce debt. While any business needs to pay back the investors, there needs to be a balance to the discussion of earning a good return while you can combined with the return to shareholders. Right now, in the oil and gas industry the discussion appears to be one sided towards dividends and debt repayment at the expense of production growth. The problem with this is that the same companies catering to debt reduction and a dividend will not likely be showing cash flow or earnings growth in the future (or reduced progress). The market does not like that either.

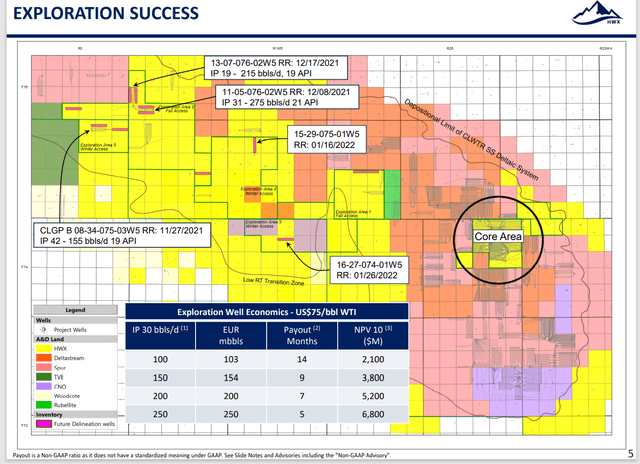

Headwater Exploration Current Exploration Success At Expanding The Profit Possibilities (Headwater Exploration February 2022, Corporate Presentation)

(Note that management already took this slide down and replaced it in the current presentation with something slightly different). Management has also been acquiring more acreage and finding considerable success of low-cost production on the additional acreage. This is a basin that has overnight become a “hot spot” due to the advance of industry technology. Everyone “knew” that the oil was there. All that needed to happen was for technology to become advanced enough to make the basin competitive with other basins. Clearly that has now happened.

The result is that this basin the relevant intervals that will be produced and more intervals that are likely worth exploring for production. Therefore, investors can look forward to years of improving reserve reports because it does not look like the whole industry is anything close to the total potential of this basin.

The main question will be whether the founders want to make a lot of money by eventually selling a larger company for a presumably big profit (because they have built and sold companies in the past) or sell a smaller business while paying dividends. Investors will point out there is some risk to reinvesting cash in a cyclical business. That risk should be offset by the experience of this management. That also means this particular investment will not be suitable for income investors. This is clearly a growth story and will remain a growth story for some time because of the large returns on wells drilled.

The emphasis on dividends and debt reduction was driven by all the speculative companies during the last cyclical boom period that featured the sizable growth of the brand-new unconventional business. The last two recoveries led to a “shake-out” that got rid of a lot of businesses that clearly had no idea how to run a business in a cyclical industry once the “newness” of the unconventional industry wore off by bringing production supplies in line with (and in excess of) demand.

What should happen going forward is a fairly normal recovery that will at some point bring on the usual cyclical downturn. But the recent restraint shown by many in the industry indicates that it will be a while before that cyclical downturn occurs. In the meantime, some consistency in Washington D.C. leadership should lead to better enterprise valuations.

Generally, the enterprise valuation declines that occurred in excess of a cyclical downturn are the results of inconsistent leadership. That inconsistency causes the market to value future earnings lower by applying a higher discount rate to account for the inconsistency risk.

Investors should therefore benefit from the high growth rates of this company combined with an improving industry valuation during the current recovery. That means this stock could be an easy triple and possibly more due to the great location and the characteristics of this recovery. Many conference calls have noted the relatively low stock price for the current cash flow levels. That should change as the future unfolds.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

from WordPress https://ift.tt/faHMhj0

via IFTTT

No comments:

Post a Comment