Brett_Hondow/iStock via Getty Images

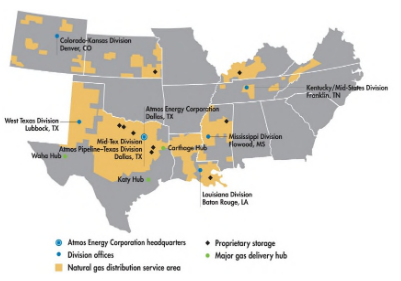

Atmos Energy Corporation (ATO) is one of the largest natural gas utilities in the United States, serving customers in eight states throughout the south-central part of the country. The company also operates as a midstream operator throughout Texas, but the utility business is by far the company’s largest operation so it should be thought of as a utility. The utility sector as a whole is generally a fairly attractive one for conservative investors such as retirees due to the relatively stable finances and high dividend yields that these companies typically possess. Atmos Energy Corporation is certainly no exception to this as the company’s 2.40% dividend yield is certainly quite a bit higher than many other things in the market. With that said though, electric utilities have been attracting much of the attention away from natural gas ones in recent years as there are many in the market that believe that electric utilities have a much stronger future. We should certainly not discount natural gas ones though and Atmos Energy certainly has a great deal to like.

About Atmos Energy Corporation

As stated in the introduction, Atmos Energy Corporation is the largest natural gas utility in the United States, serving about three million customers in eight states in the southcentral part of the country:

Atmos Energy Analyst Presentation

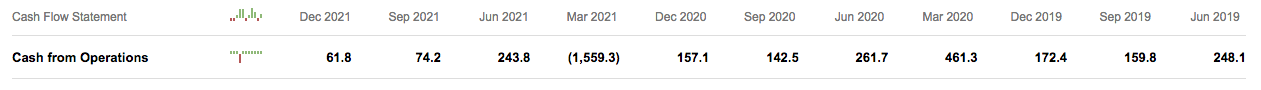

The company also owns and operates midstream pipeline and storage assets that cover the state of Texas. However, the utility business accounts for 68% of the company’s net income so this is the one that most people are interested in when they invest in Atmos Energy. Atmos Energy does possess most of the characteristics that other utilities do, such as generally stable cash flows over time. This stability makes a great deal of sense since utilities in general provide a product that is generally considered to be a necessity in today’s world. As such, people will typically prioritize paying their utility bills over more discretionary expenses. We can see this general stability by looking at the company’s operating cash flow over time. Here they are:

Seeking Alpha

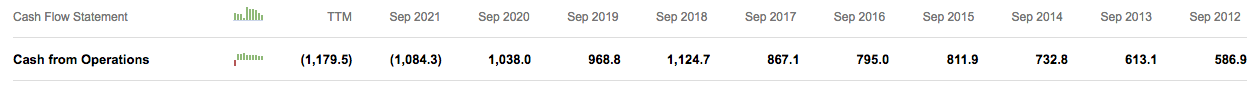

There may be some people that point out that the company’s operating cash flow appears to fluctuate significantly from quarter to quarter but this is not abnormal for a natural gas utility. This comes from the fact that natural gas is used primarily as a heating fuel so it is much more heavily consumed during the colder months of the year. As the company makes its money based on the volume of natural gas that its customers consume, it will naturally see the bulk of its revenues and cash flows during the heating season. We can see much more stability if we look at the company’s full-year operating cash flows over time. Here they are:

Seeking Alpha

We can certainly see reasonably stable cash flows here with the exception of this past year. That quarter was an outlier though since it was caused by a one-time event. Atmos Energy suffered a total of $2 billion in costs due to the February 2021 Texas deep freeze weather event that could ultimately be recovered. The company incurred these costs due to having to purchase natural gas at the incredibly high prices that were prevalent during that event, which is most likely a weather event that will not happen again during our lifetimes. If we back that out, we can see that the company’s cash flows would have been very stable over the multi-year period.

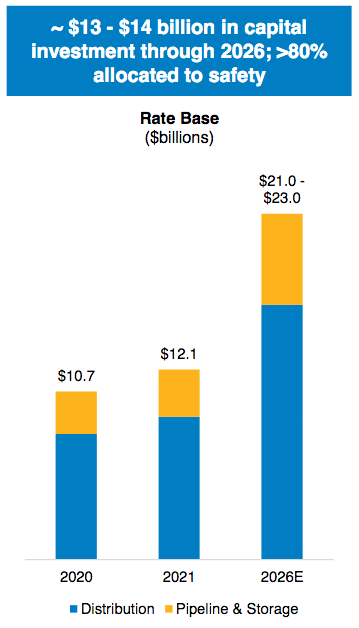

Another thing that we see here is that the company’s operating cash flow has generally trended upward over time. This is a defining characteristic of utilities as they tend to deliver slow but steady growth over the long term. This is because these firms are constantly investing in growing their respective rate bases. The rate base is the value of the company’s assets upon which regulators allow it to earn a specified rate of return. As this rate of return is a percentage, any increases to the rate base allow the company to increase the price that it charges its customers in order to earn this specified rate of return. In the case of Atmos Energy, this regulatory approved rate is 9.8%, which is relatively in line with the utility sector as a whole. The usual way that a utility grows its rate base is by investing money into constructing, upgrading, modernizing, and even expanding its utility infrastructure. Atmos Energy intends to do exactly this as the company currently plans to invest approximately $13 to $14 billion into improving its infrastructure over the 2022 to 2026 period. This can be expected to boost the company’s rate base from $12.1 billion today to approximately $22 billion in 2026:

Atmos Energy Analyst Presentation

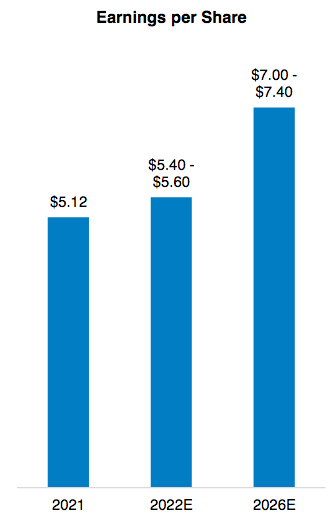

There will almost certainly be some people that point out that this projected growth in the rate base is significantly less than the money that the company is planning to spend in growing it. There are two reasons for this. The first reason is that some of the newly-purchased equipment will replace older equipment that the company will take out of service. The value of this retired equipment is removed from the company’s rate base at that time. The second reason is that depreciation reduces the value of a company’s hard assets over time. As a result, an item that the company purchases this year will have a lower value in 2026. In short, the company’s rate base would decline every year in the absence of any new investment into it. Thus, the capital spending program needs to be large enough to both overcome the impacts of this and still achieve the desired growth. The one that Atmos Energy has proposed is clearly large enough to accomplish this. As the company will be able to adjust its prices upward as the rate base grows, this growth will allow the company to grow its earnings per share at a 6% to 8% rate over the period:

Analyst Energy Analyst Presentation

When we combine this with Atmos Energy’s current 2.40% yield, investors should be looking at an 8% to 10% return total return over the next five years. This is certainly more than reasonable for relatively conservative utility investments.

Over the past several years, there has been a growing focus in society on sustainability. We saw this in a big way when the pandemic broke out and many renewable stocks surged in the capital markets. We can also see it in the fact that environmental, social, and governance funds now account for 10% of all worldwide mutual fund assets. Many investors would likely not consider a natural gas utility to be in this category because natural gas is a fossil fuel and as such it will always produce some carbon emissions and the utility cannot do something like deploying solar panels to produce it (although there are some ways to produce natural gas that are less carbon-intensive than drilling into the ground). As such, it may be somewhat surprising to hear that a not-insignificant part of the company’s planned capital investments is into sustainability programs and improvements. One of the big things that it is doing is modernizing its infrastructure. This supports a sustainable infrastructure program because modern pipelines and similar things tend to be more reliable and have far fewer leaks than older infrastructure, which results in fewer methane emissions into the atmosphere (and saves the company money because less natural gas gets wasted). Atmos Energy is also investigating the use of renewable natural gas in its distribution network. This is a sustainable way to produce natural gas, which was hinted at earlier in this paragraph. Renewable natural gas is produced by collecting a gas that is emitted by decaying organic matter and then upgrading it to match the composition of dry natural gas. As organic matter can be found pretty much anywhere and this decaying process will always occur, this form of natural gas is sustainable. This is also a very affordable and viable near-term solution because renewable natural gas can be distributed using the existing infrastructure and utilizing existing natural gas appliances. As such, many natural gas utilities are pursuing this as a current sustainability initiative in response to the demands of customers.

Fundamentals Of Natural Gas Utilities

As stated in the introduction, electric utilities have been attracting much of the attention of investors lately as opposed to pureplay natural gas utilities. This is mostly due to the electrification trend that has been widely promoted by government officials and those pushing for the implementation of a “green” economy. At its core, electrification refers to the conversion of things that are traditionally powered by fossil fuels to the use of electricity instead. The two most commonly cited areas of the economy to be converted are transportation (electric cars) and space heating. As the second of these is the primary use of natural gas, it is fairly easy to see how this would benefit electric utilities at the expense of natural gas ones.

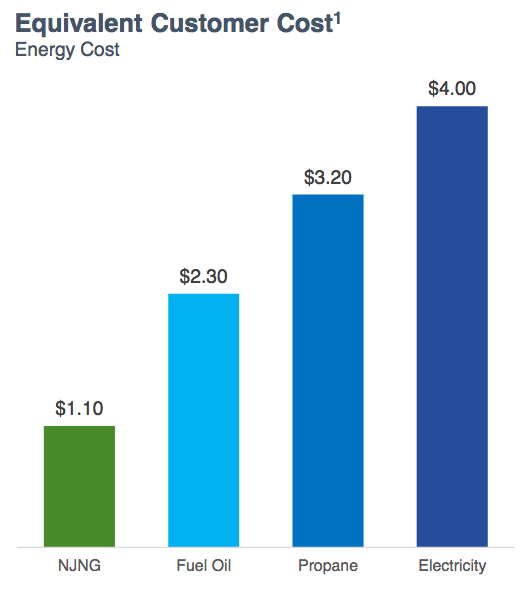

However, as I pointed out in a recent article, it is highly unlikely that this trend will progress anywhere near as rapidly as its proponents do. This is a view that is shared by the United States Energy Information Administration, which projects that the national consumption of electricity will only grow at a 1% to 2% rate over the next thirty years. That is much lower than the growth rate that we would see if wide swathes of the economy were to convert from fossil fuels to electricity so the agency appears to believe that natural gas will be with us for a very long time. One of the biggest reasons for this is efficiency. To put it simply, electricity is far less efficient at producing heat than natural gas. As a result, it can cost more than three times as much to heat a home with electricity as with natural gas:

New Jersey Resources/Data from US EIA

It seems fairly unlikely that very many people would willingly incur this higher cost simply to reduce their carbon footprints. This is particularly true for those on limited incomes or living in colder climates. While it is perhaps possible that one day this problem will be overcome, this is not expected to happen anytime soon. In fact, many projections state that this is unlikely prior to 2050. As such, it does not appear likely that investors in natural gas utilities need to worry about their company becoming obsolete anytime soon.

Financial Considerations

It is always critical that we look at the way a company finances itself before making an investment into it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. As very few companies keep enough cash on hand to repay debt as it matures, this is typically accomplished by issuing new debt to replace the maturing debt. Depending on the economic conditions at the time, this may not be possible to do at the same interest rate and could therefore result in an increased expense for the company. In addition to this, the company must make regular payments on its debt if it is to remain solvent. Thus, a decline in cash flows could cause it to run into financial problems if the company has too much debt. Although the cash flows of utilities tend to be remarkably stable, bankruptcies are certainly not unheard of in the sector.

One metric that we can use to analyze a company’s financial structure is the net debt-to-equity ratio. This tells us the degree to which the company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well the company’s equity will cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important.

As of December 31, 2021, Atmos Energy Corporation had $7.6507 billion in net debt compared to $8.2895 billion in shareholders’ equity. This gives the company a net debt-to-equity ratio of 0.92. Here is how that compares to some of the company’s peers:

|

Company |

Net Debt-to-Equity |

|

Atmos Energy Corporation |

0.92 |

|

New Jersey Resources (NJR) |

1.74 |

|

South Jersey Industries (SJI) |

1.79 |

|

Northwest Natural Holding Company (NWN) |

1.60 |

|

NiSource Inc. |

1.36 |

|

Southwest Gas Holdings (SWX) |

1.97 |

As we can see here, Atmos Energy Corporation has by far the lowest proportion of its operations funded by debt of all of its peer group. This is something that should provide a great deal of comfort to potential investors since it should indicate that the company’s leverage poses minimal risk.

Dividend Analysis

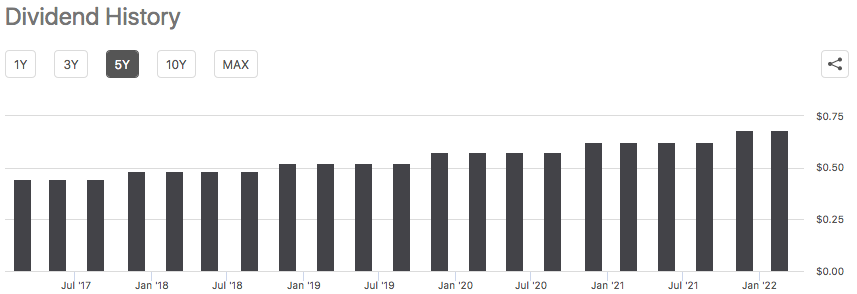

One of the reasons that many investors purchase shares of utility companies is because of the relatively high dividend yields that they tend to possess. The biggest reason for this is that utilities, in general, tend to be relatively low growth companies so they deliver a larger proportion of their total return to investors through the dividends that they pay out than a company that can deliver much higher earnings growth, which would likely favor capital gains. Atmos Energy Corporation is no exception to this as the company’s 2.40% current yield is significantly higher than the 1.34% current yield of the S&P 500 index (SPY). As is the case with many utilities, Atmos Energy Corporation has a history of steadily increasing its dividend over time:

Seeking Alpha

A history of steady dividend increases is something that is quite nice to see, particularly in today’s inflationary environment. This is because the rising prices that we see in such an environment reduce the number of goods and services that we can purchase with the dividend that the company pays us. If the company increases its dividend regularly then this helps to offset this effect because it will be giving us more money. As is always the case though, it is critical that we ensure that the company can actually afford the dividend that it pays out. After all, we do not want it to be forced to reverse course and cut the dividend. That scenario would both reduce our incomes and almost certainly cause the stock price to decline.

The usual way that we judge a company’s ability to pay its dividend is by looking at the free cash flow. A company’s free cash flow is the amount of money that is generated by its ordinary operations that is left over after it pays all its bills and makes all necessary capital expenditures. This is the money that is available to perform tasks such as paying a dividend, reducing debt, or buying back stock. In the fourth quarter of 2021, Atmos Energy Corporation reported a negative leveraged free cash flow of $670.5 million. This is obviously not enough to pay any dividend, let alone the $90.4 million that the company actually paid out during the period.

With that said though, it is fairly common for a utility to finance its capital expenditures via the issuance of debt and equity and fund its dividend out of operating cash flow. This is largely due to the incredibly high expenses related to constructing and maintaining utility-grade infrastructure over a wide geographic area. In the most recent quarter, Atmos Energy Corporation had an operating cash flow of $61.8 million, which is likewise not enough to finance the $90.4 million that it actually paid out. However, please recall our earlier discussion about the seasonal nature of a natural gas utility’s cash flows. As a result of this seasonal nature, it makes the most sense to use the company’s annual numbers for the dividend analysis. Unfortunately, in this case, this does not improve the situation due to the $2 billion one-time cost that it took back in February 2021. This loss resulted in the company having a negative trailing twelve-month operating cash flow of $1.1795 billion. If we were to exclude this though, the company would have had an operating cash flow of $861.4 million, which is enough to cover the $335.3 million that it paid out in dividends during that same period and still leave a significant amount of money left over to cover other expenses. Overall then, the dividend is probably sustainable and should not give us too much to worry about.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to receive a suboptimal return off that asset. In the case of a utility like Atmos Energy Corporation, one metric that we can use to value it is the price-to-earnings growth ratio. This ratio is a modified form of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. A ratio of less than 1.0 is a sign that the stock could be undervalued relative to its forward earnings per share growth and vice versa. However, there are very few stocks that have such a low ratio in today’s market, which is doubly true in the slow-growing utility sector. As such then, it will make more sense to compare the company’s valuation to some of its peers in order to see which offers the most attractive relative valuation.

According to Zacks Investment Research, Atmos Energy Corporation will grow its earnings per share at a 7.28% rate over the next three to five years. This is relatively in line with management’s projections so it does seem pretty solid. This gives the company a price-to-earnings growth ratio of 2.82 at the current price. Here is how that compares to the company’s peer group:

|

Company |

PEG Ratio |

|

Atmos Energy Corporation |

2.82 |

|

New Jersey Resources |

3.27 |

|

South Jersey Industries |

NA |

|

Northwest Natural Holding Company |

4.29 |

|

NiSource Inc. |

2.88 |

|

Southwest Gas Holdings |

3.20 |

As we can see here, Atmos Energy Corporation appears to have the most attractive valuation out of any of its peers, although NiSource is very comparable. This adds to the company’s appeal since we can get access to its incredibly strong balance sheet at a bargain price.

Conclusion

In conclusion, Atmos Energy Corporation has a great deal to like despite the market being much more excited about electric utilities than natural gas ones right now. However, the current discussion about everything converting to electrification making gas utilities obsolete is quite premature. In fact, it is likely that the future of natural gas utilities is quite long-term. The company boasts a very attractive total return potential, strong balance sheet, and valuation. Overall, this one looks like a winner.

from WordPress https://ift.tt/hI9sSDo

via IFTTT

No comments:

Post a Comment