Chris Hondros/Getty Images News

Investment thesis

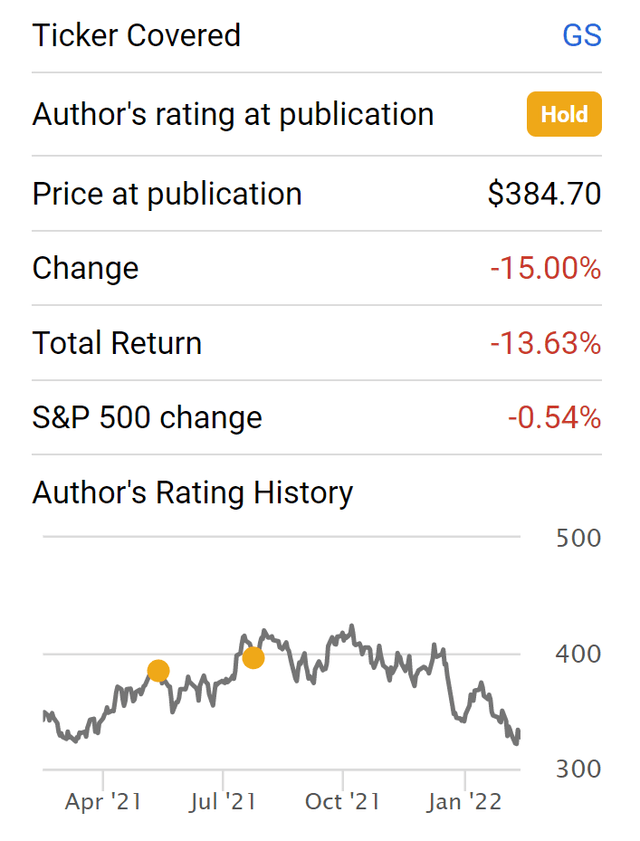

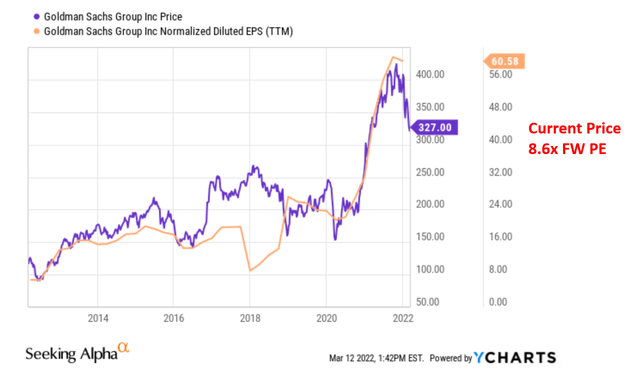

I first wrote about Goldman Sachs (GS) back in June 2021 under the title “An Asset/Income Valuation Suggests Overvaluation“. The stock price has indeed fallen by about 15% since then. Particularly, recent price corrections, as seen from the following chart, brought its valuation to a reasonable level.

Seeking Alpha

Despite the reasonable valuation, you will see why I am still holding a neutral view of the stock and will remain on the sideline. In particular,

- On the positive side, you will see that it is attractively valued in terms of PE multiples. From a completely independent perspective, its current valuation is also attractive in terms of its assets and income valuation. Its investment activity remains high. And its recent acquisitions of NN Investment Partners and GreenSky both help to further strengthen its strategic positions.

- However, on the negative side, it is over-earning on its assets and my concern of profitability reversion remains. Also, current macroeconomic and geopolitical uncertainties can impact it in unpredictable ways. It has just announced its plan to exit Russia, becoming the first major Wall Street bank to announce plans to do so after the invasion of Ukraine.

Assessment 1: P/E valuation

Thanks to its premium status and growing footprint in consumer finance, GS enjoys strong and stable organic income. In its most recent earnings report, it delivered a strong performance in the third quarter, reporting revenues for the period of $15.2 billion, up 20% from the previous-year period.

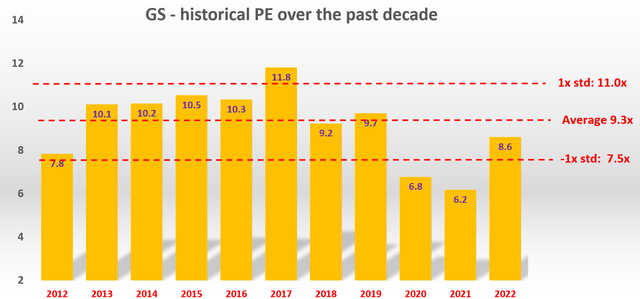

In the long term, GS has been rewarding investors handsomely through a combination of earnings growth, dividends, and share repurchase. In terms of PE multiples, as seen from the following chart, GS has been on average valued at 9.3x historically. And shareholders have been often rewarded by valuation expansion over the past.

Author based on YCharts data

In particular, the recent price correction has brought its PE to be near its historical mean of 9.3x. The following chart shows the annual average PE of the stock in the past decade. You can see the cyclical nature given its business cycles. As seen, the average is 9.3x and the standard deviation is ~1.8 (also note the large volatility here). The current FW PE is about 8.6x, slightly below the historical average but within the 1-sigma variation. Obviously, there is no reason why the PE has to be around mean. But for a stable and well-established stock like GS, there is no reason to expect a sudden quantum leap in its valuation either. And a large part of being a conservative investor means to be aware of the rule of reverse selectivity – I am more inclined to expect something old to repeat itself again than to expect something completely new to show up.

Author

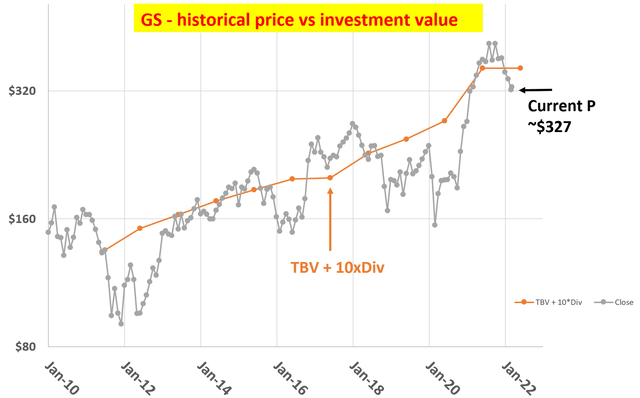

Assessment 2: the Asset + Income Valuation approach

Now from a totally independent approach, let’s assess its valuation in terms of asset/income purchases. For stable financial stocks like GS, another very intuitive and effective valuation approach that we use ourselves is based on its asset and income. The essence of the idea is that:

• If you think like a long-term business owner (instead of a stock trader), then investing in financial stocks is nothing more than buying their asset to collect an income. So the investment value consists of two parts: the value of the asset itself and the future income.

• Our valuation method approximates the first part by its tangible book value (“TBV”) and the second part by 10x of its dividends. In other words, the investment value (“IV”) should be:

IV = TBV + 10 x dividend

• This method offers the advantage of valuation anchored in the most easily obtainable data with the least amount of uncertainty: BV and dividend. In investing, we always prefer the use of a few data points that are reliable than many data points that are less reliable.

As seen from the following chart, the current IV, based on its current TBV and dividend is substantially above its current price of $327. The stock represents a premium banking business for sale at an attractive price under today’s overall expensive market, consistent with the common PE assessment mentioned above.

Author based on Seeking Alpha data

GS stock – Projected returns

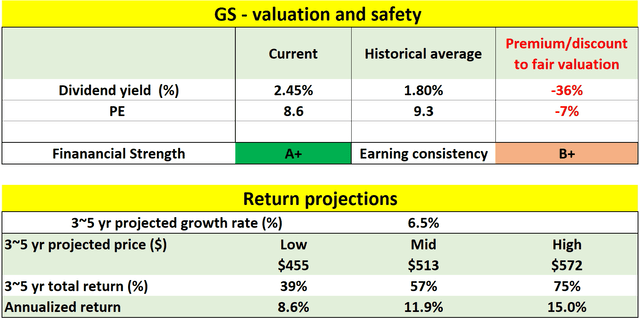

As can be seen from the following numbers in the table, at its current price level, it’s very reasonably valued now. It’s about 7% undervalued based on historical PE multiples. Notably, its current dividend yield is significantly above the historical mean with the recent 60% dividend raise.

Looking forward, for the next 3~5 years, a mid-single-digit annual growth rate is expected (near 6.5%) due to A) its strong and stable cash generation and B) its active bolt-on acquisitions as aforementioned. And the total return in the next 3~5 years is projected to be in a range of 39% (the low-end projection) to about 75% (the high-end projection), translating into a healthy 8.6% to 15% annual total return.

The business also enjoys superb financial strength (A+), but earnings fluctuate substantially due to the cyclical nature of the business as elaborated more in the risk section below.

Author based on Seeking Alpha data

Risks

- Also, current macroeconomic and geopolitical uncertainties can impact its operations in unpredictable ways. It has just announced its plan to exit Russia, becoming the first major Wall Street bank to announce plans to do so after the invasion of Ukraine.

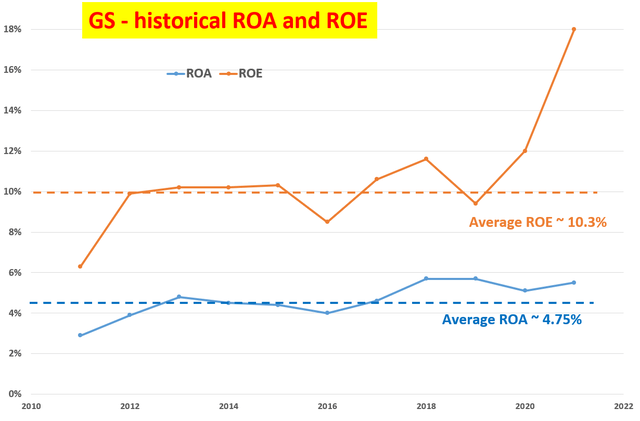

- It is also over-earning on its assets and I am concerned about its profitability reversion. As seen from the following chart, its return on asset (“ROA”) has been averaging 4.75% in the past decade. And its return on equity (“ROE”) is near 10% – very typical for premium banking stocks. then note that its current ROA and ROE are dramatically above the historical mean. I myself am more cautious about this. If taking 10 years as an approximation for a business cycle, I am more cautious about its profitability reversion to the historical mean in the years to come.

Author

Conclusion and final thoughts

Recent price corrections have brought GS’ valuation to a more reasonable level, even a bit undervalued. However, I am still holding a neutral view about the stock and will remain on the sideline for the following concerns:

- Current macroeconomic and geopolitical uncertainties can impact its operations in unpredictable ways (for example, it has just announced its plan to exit Russia).

- It is also over-earning on its assets and I am concerned about its profitability reversion. Its ROA has been averaging 4.75% in the past decade, and its ROE is near 10%. But its current ROA and ROE are dramatically above the historical mean, and I am cautious about its profitability reversion to the historical mean.

from WordPress https://ift.tt/Ah2MRQj

via IFTTT

No comments:

Post a Comment