Aguus/E+ via Getty Images

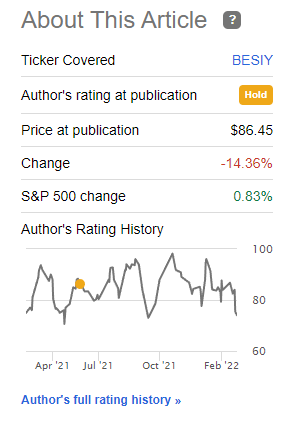

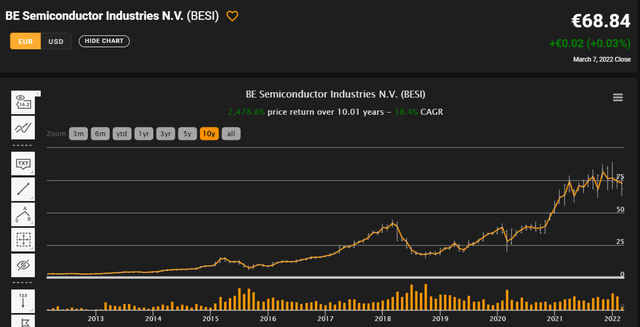

In my last article on BE Semiconductor Industries (OTC:BESIY), also known as BESI, I established a "HOLD" thesis for the foreseeable future due to the valuation of the company.

This valuation, and the situation, has changed somewhat since the publishing of this article.

BE Semiconductor Industries Article (Seeking Alpha)

My current thesis on BESI will be updated in this article.

BE Semiconductor Industries - A recap and earnings

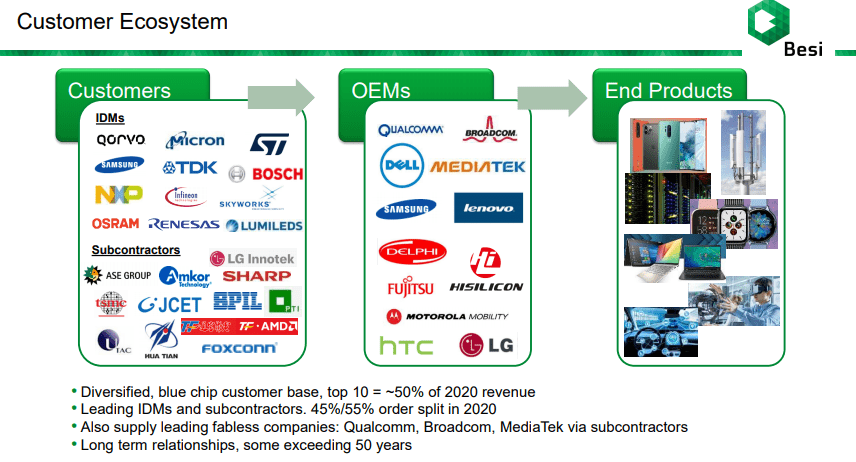

As I wrote in my initial piece on this company, what we're looking at is a relatively small Dutch business working as a supplier of high-tech assembly equipment. Despite its small and underfollowed status, it has a #1 and #2nd place in market share in some key markets and owns a double-digit market share of the current market on a global scale.

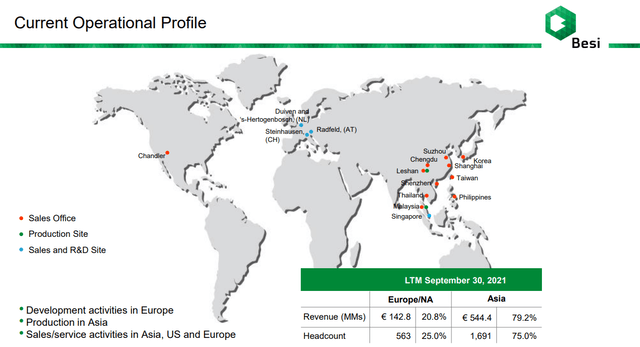

With manufacturing operations in 6 nations and around 2,000 employees, the company is a small player with overall good financials and fundamentals, able to show some extremely positive development over the course of 10-15 years. However, remember that the payout ratio is extremely high at 97%, it lacks a credit rating, and smaller companies definitely have higher amounts of volatility risks than larger companies.

BESI is a Die attach Operations business, with almost 20% of overall revenue from this. For a more comprehensive explanation of what exactly the company does, I refer you to my original article.

For now, rest assured that the company does it for most major companies in the entire world.

BESI Operations (BESI IR)

Remember that this company boasts significant, cyclical tendencies in terms of earnings even if their long-term development over time is a very positive one. I consider it likely that we'll see a bullish market for BESI due to semi shortages globally, which speaks against the company's recent price action.

This is highlighted by the FY20 results which see revenue growth of almost 73%, almost 100% order growth, 114% net income growth (and only 25% R&D gross growth), and a 86% increase in net cash.

The company's RoE stands at class-leading 57% on an average basis, up 17.5% YoY. The company's dividend for 2021 is doubled to €3.33/share, to a dividend payout ratio of 92%, in line with the company's history.

On a high level, results were extremely good for the company, representing a bounce.

The company's operational profile and manufacturing have close-to-zero Russian/Ukraine exposure, beyond the indirect one.

BESI Operational Profile (BESI IR)

The risks to investing in this company should be well-known here. The company's cyclical earnings deliver what I would describe as short-term uncertainty to both dividends and returns. In order to invest in BESI, you need to be able to stomach the ups and downs, even if it's abundantly clear from the long-term returns that this company is good at delivering the goods, so to speak.

BESI 10-year Returns (S&P Global/TIKR)

The question is if this performance is in any way repeatable. I would say that provided you buy the company at the "right valuation", that is most certainly the case.

At a current implied dividend of €3.3, the BESI yield here is almost 5%. That's a high yield, especially for this segment. I wouldn't argue that this level can be expected to be maintained over a long time, but it's definitely a new level of income where I don't see us going back below €2.5/share in the long term.

The world increasingly relies on Semis - and BESI controls a certain market share of a crucial component of this value chain. No, the fundamentals of this company and the upside - the thing that drives this company's business - that's very much intact here.

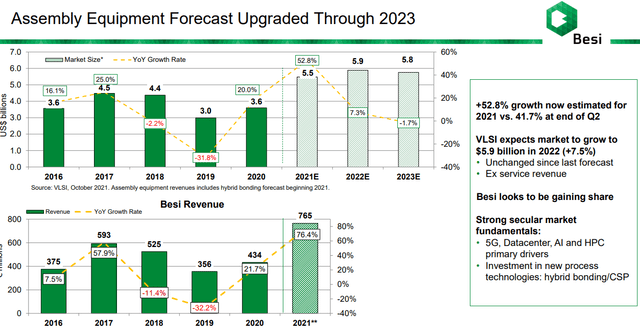

Overall, my research shows that what drives BESI's trends are macro things like GDP trends, Customer roadmap timing, cycle times and scalability of products, and overall demand trends. What's positive is that most of these are seeing growth/positive demand trends.

BESI Demand Forecast (BESI IR)

I would say the visibility for demand here is very good, and therefore I view the potential here as positive. I would argue that BESI is, based on the demand we're seeing here, a potentially excellent investment at the right sort of price.

The Assembly equipment market remains a beast of around $3.6B globally, and BESI, as of 2021, is up to almost 12% of the entire market, with a 30% market share in the actual addressable market by the company. In terms of Die attachment, BESI's market share grows to almost 37%.

On a high level - because of the company's excellent capabilities, results and trends, I foresee the company growing significantly over the next few years, with a growth in earnings as well as other metrics as a result. Recent earnings do nothing in terms of adding risk to this investment profile. The risks remain known, and the ones I've spoken about in the past (namely size, lack of credit rating, dividend volatility, EPS volatility).

BESI Valuation

BESI does have some peers we can look at, even if these usually trade in different sub-segments of the overall field. Some examples are ASML Holding (NASDAQ:ASML), Applied Materials (NASDAQ:AMAT), ON Semiconductor (NASDAQ:ON), Teradyne (NASDAQ:TER), and others. None of these are precisely "right", and they also share a massive difference in average P/E multiples, ASML as high as almost twice that of BESI, with others quite a bit lower overall.

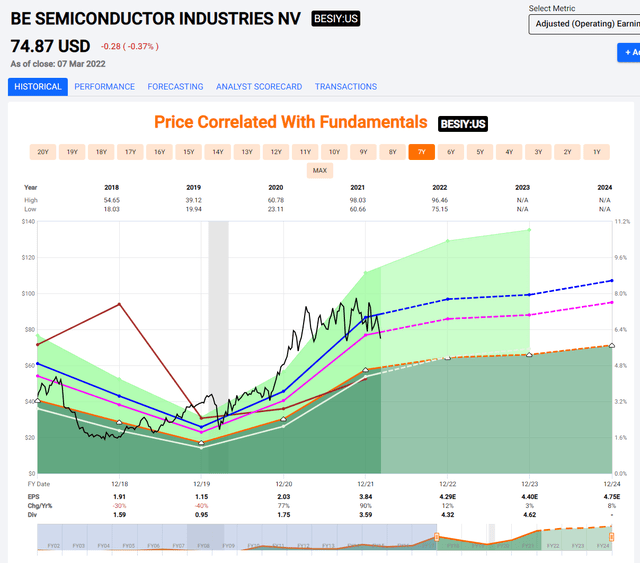

Instead, I would use historicals, DCF, and NAV valuations to reach an average share price target for the company that could be considered fair long-term. Analysts estimate, similar to BESI, that the company will average EPS drops in around double digits following this blowout 2021 (Source: S&P Global). They also expect significant dividend increases, which I would take a bit more with a grain of salt - although if EPS increases are linear, everything else being equal, expect BESI's dividend to rise as well.

Analysts or the company aren't forecasting any sort of worsening EBITDA or profit margin. Quite the opposite. Going forward, the company is expected to actually improve those EBITDA margins significantly to above 45% in 2022, which is up from around 24% back in 2016 thanks to scale, efficiency, and pricing.

Because the positive expectations for the future are looking at this, I'm increasing as opposed to lowering my price targets for BESI. I see a high likelihood of this materializing, and I don't see things getting easier in the semi business.

In fact, I argue that BESI now trades closer to a fair-value average of 18-19X than it has since the pandemic. The time has come to really start looking at BESI seriously.

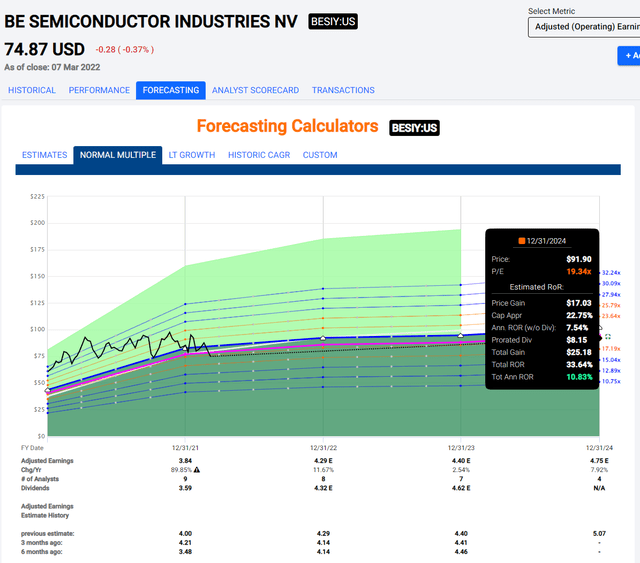

BESI Upside (F.A.S.T graphs)

Following this drop, I really like where I see BESI being valued. I don't think it's likely we'll see sub-16X P/E levels for the company in this semiconductor state of affairs, but if we did, I would increase my pace of buying.

As of this article, I'm bumping my price target for BESI to an 18X average P/E. Going by 2021A and 2022E-2024E, this averages out to around $78/share.

That's my new price target for BESI. What this implies is a very conservative 4-year average annualized RoR of 11%. And it could go far higher than this, if history is anything to go by.

BESI Upside (F.A.S.T graphs/FactSet)

Going by historical premiums, the upside for BESI could be as high as 15-16% on a conservative historical of 20-22X P/E. What's more, this is at a dividend yield based on a €3.3/share dividend, meaning almost 4.8% here. That's a good dividend, a good upside, and a good set of fundamentals.

S&P Global analysts agree with the fact that there's a massive upside to BESI. They currently give the company an average of €75-€160, which is of course somewhat ridiculous, but averages out at around €99/share. Out of 8 analysts, 7 currently have a "BUY" or "Outperform" rating.

This company most certainly, to me, is a "BUY" here.

Thesis

I'm extremely careful about investing in Semiconductors or IT businesses at this time. Most of them have prohibitively high valuations, low yields, low return prospects, or weak fundamentals. While BESI lacks a formal credit rating, it has no shortage of quality.

And while it may be a small player, it's a small player with a very important overall part to play. Its market share of a crucial market is absolutely massive. It has the fundamentals, the customer base, and the diversified production to succeed and be a bit of a risk-off play in this environment, even if part of their production is based in China. This company carries extremely strong gross margins of over 60% at times, related to the company's "flexible" Asian production and workforce. BESI also executes extremely tight overhead management, which leads to a very significant operating leverage with excellent baseline OpEx based on the company's revenues.

So, based on all of this and what I've said in the article, I view BESI as a "BUY" here with an upside of at least 8-10% annually and a price target of $78/share.

Remember, I'm all about:

1. Buying undervalued - even if that undervaluation is slight, and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn't go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

If you're interested in significantly higher returns, then I'm probably not for you. If you're interested in 10% yields, I'm not for you either.

If you however want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Thank you for reading.

No comments:

Post a Comment